Since 2012, the Revenue Department (“RD”) has had a policy of supporting the preparation and delivery of electronic tax invoices (“e-tax invoices”) or electronic receipts (“e-receipts”) to support electronic transactions in the private sector and to increase the efficiency of electronic services (“e-services”) of the government.

The Revenue Department has developed a service system for preparing and delivering e-Tax invoice & e-Receipt (e-Tax invoice & e-Receipt) by setting criteria and developing the system to be flexible and convenient to use. To improve the electronics data format to be an international standard so that relevant agencies, both public and private sectors can use them efficiently.

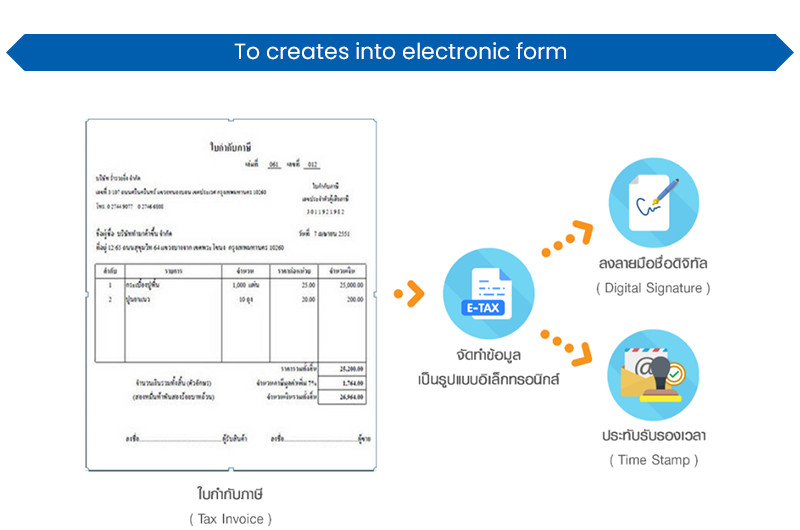

Tax invoice information (full and abbreviated), including debit notes, credit notes, and receipts that the Entrepreneurship creates as an evidence for buyers of goods or services in electronic form* with a digital signature or time stamp via e-Tax Invoice by Email system. *Example PDF, PDF/A-3, XML, etc. with a digital signature with a certificate of entrepreneurship.

Credit: https://etax.rd.go.th/etax_staticpage/app/#/index/aboutinfo/overview#top

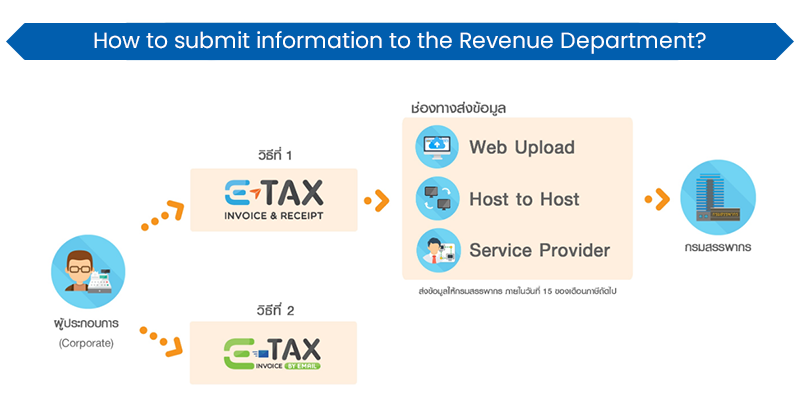

There are 2 forms to submit information to the Revenue Department, which the operator can choose to use only one method.

* Choosing to use only one method

* Choosing to use only one method

** File for web upload must be not over 2MB

Credit: https://etax.rd.go.th/etax_staticpage/app/#/index/aboutinfo/overview#top

1

| 2

| |

| Document | Tax invoice, receipt, debit note, credit note | Tax invoice, debit note, credit note |

| Submission method |

|

|

| Entrepreneurship income | unlimited | Not over 30 MTHB/Year |

| Data verification | Electronic Certificate and Digital Signature | Time Stamp |

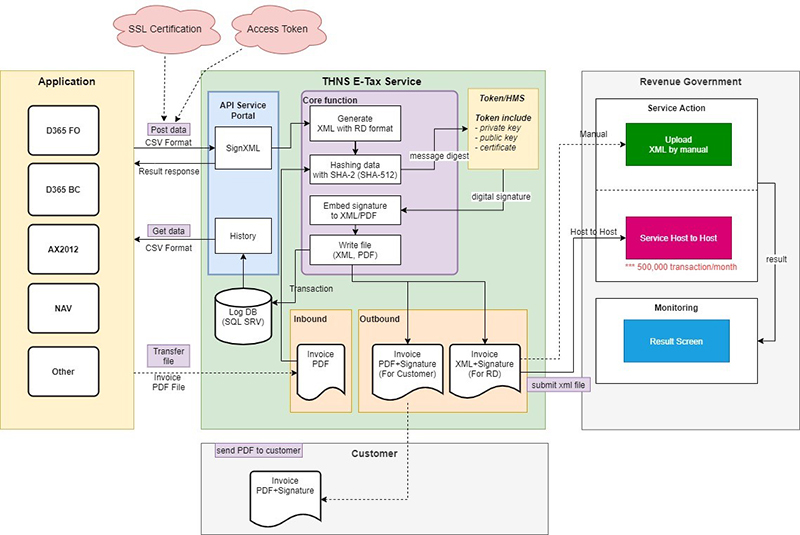

Many organizations already have core systems such as ERP systems to support business operations then you should choose an e-Tax system that can be used in conjunction with the existing system seamlessly. Moreover, the system provider is also important. The system provider should be reliable, has experience to support system for customers and has a team that is ready to help when the system has problem.

We, Thai NS Solutions have our own developed “THNS E-TAX Service” system that is compatible with Microsoft Dynamics NAV, AX, Business Central, and Finance. We also have experiences to implement, develop, and support system for customer. We are confident that our experiences and team are ready to support your needs.

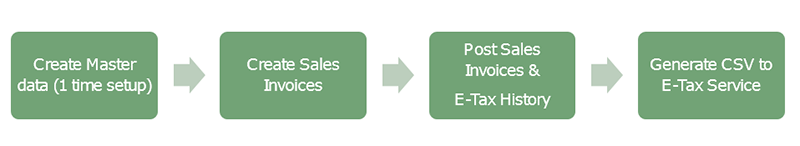

To create e-Tax or electronic tax invoices by THNS E-TAX Service can be done easily in a few steps

The e-Tax information or electronic tax invoice that is generated by THNS E-Tax Service will come out in 2 formats.

| Party | Format |

| The Revenue Department | XML + Digital Signature |

| Customer | PDF + Digital Signature |

| No. | Detail |

| 1 | Workflow to approve Sales invoice and Sales credit note |

| 2 | Workflow to approve Credit Receipt Journal |

| 3 | Auto Email Invoice to Customer - PDF + Digital Signature format. |

Need more information?

contact@th.nssol.nipponsteel.com

Telephone: 096-730-6635/ 080-278-2849 (Japanese/English)

085-394-2130 (Thai/English)

29-07-2021