Divided We Stand

As of October 1, 2025

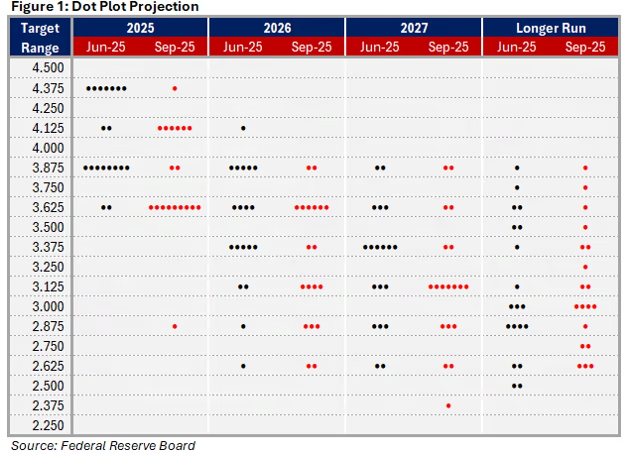

The Federal Reserve’s September projections revealed anything but consensus. The dot plot showed a wide dispersion of views with policymakers split on growth, inflation, and the pace of rate cuts. Rather than a single roadmap, investors are left navigating with a broken compass, as the Fed’s divisions are now the signal.

Macro & Policy Outlook: A Fed Without Consensus

The September Summary of Economic Projection (SEP) reinforced the depth of uncertainty. Growth expectations were revised slightly higher to 1.6% for 2025, suggesting modest resilience in the economy. The unemployment rate projection remained unchanged at 4.5%, compared with the current 4.3%, suggesting only mild softening in the labor market. Inflation remains elevated, with core PCE still forecast at 3.1%, reinforcing the Fed’s cautious stance.

The dot plot illustrated just how divided the Committee has become (Figure 1):

- Seven members see no further cuts in 2025

- Eleven members expect one or two cuts

- One member projects as many as five cuts

One Data at a Time

Chair Powell framed the September rate cut as a “risk management”1 move, essentially an insurance policy. With unemployment still near historic lows and inflation proving sticky, the Fed is trying to strike a delicate balance: not waiting too long to ease while also preserving flexibility should inflation reaccelerate.

This balancing act makes each new data release critical. Inflation readings, labor market updates, and wage growth figures now have the power to swing expectations and determine whether the Fed leans toward patience or toward accelerating easing.

Beyond the Fed?

When the Fed’s internal compass no longer gives a singular direction, investors must chart their own course. That means focusing on businesses whose performance is not tied to every policy shift2. A few themes stand out.

Scalable Platform Businesses: Companies with network effects or subscription models that thrive even if capital remains high.

Wage Sensitive Service Firms3 : As wage pressures ease, service and staffing companies could see margin relief.

Global Exporters: Firms that benefit when the dollar strengthens or when shifts in policy support cross border flows.

In the short run, the noise from rate speculation may dominate headlines, but over the longer horizon the base case still points toward lower rates in 2026 and beyond. That suggests opportunity for equities that combine resilience with optional upside. The challenge is not picking a single path but maintaining exposure to companies that can flex as the data evolves.

1Open Market Committee statement. https://www.federalreserve.gov/monetarypolicy/fomc

2McKinsey & Company, How smart companies can thrive amid uncertainty

↑ Back to top