A Pivotal Week for US Markets

As of July 25, 2025

Fed Decision, Big Tech Earnings, Key Economic Releases—and Treasury Issuance All Collide

This week marks a rare and powerful convergence of market-moving catalysts that could swing markets sharply. With many market participants stepping away for summer vacations and liquidity running thin, even modest surprises could trigger outsized moves. A packed calendar—including a pivotal Fed meeting, Big Tech earnings, key economic releases, Treasury issuance, and looming tariff deadlines—creates an environment where short-term shocks could reverberate well beyond this week and set the tone for the rest of the summer.

First, all eyes are on the Federal Reserve.

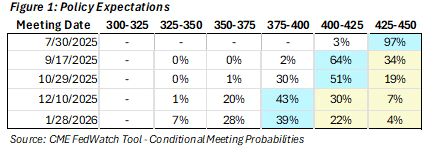

Market consensus is that FOMC will leave rates unchanged, but the markets are looking for any pivot toward easing, with September viewed as the earliest likely timing for a cut (Figure 1: 64% probability). Markets appear vulnerable to disappointment if the Fed does not explicitly signal September as the likely timing for the next policy move.

Simultaneously, the busiest stretch of Q2 earnings season is underway.

Within 48 hours, four of the “Magnificent Seven”—Meta Platforms, Microsoft, Apple, and Amazon—will report results. These companies wield outsized influence over major indexes and market sentiment. With expectations already sky-high, merely beating estimates by a narrow margin may not be enough; any disappointment could spark sharp moves.

A flood of economic data adds another layer of uncertainty.

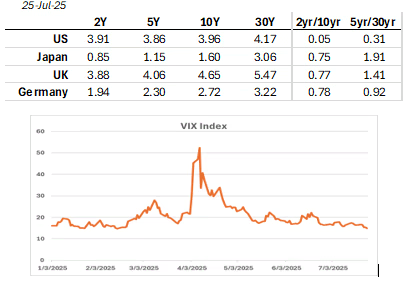

Q2 GDP, the Fed’s preferred inflation gauge (core PCE), and the July jobs report will offer fresh insight into the health of the economy at a time when investors are still gauging the impact of tariffs, slowing growth, and persistent wage pressures. The results could meaningfully shift expectations for monetary policy and drive volatility.

Tariffs remain a major wildcard.

The key dates are August 12 when the temporary 90day suspension on elevated US–China reciprocal tariffs expires , risking a surge toward ~34% on Chinese goods, and August 1 when reciprocal tariff rates on goods from Canada, Mexico, Japan, and others are due to rise (unless covered by USMCA or recent trade deals). For non USMCA imports, Canada and Mexico face tariff increases to ~25–30%, and Japan to ~25% (some sectors locked in at ~15% under new bilateral agreements). Such broad-based tariff hikes would raise import costs across key consumer and industrial goods, potentially adding upward pressure to core inflation just as the Fed is attempting to cool price growth. Markets are watching trade negotiations closely, as any breakthrough or breakdown on either front could deliver another shock to a fragile backdrop of thin liquidity and heightened Fed sensitivity.

Treasury issuance completes the picture.

This week brings a full slate of debt sales, culminating in Wednesday’s quarterly refunding statement . With deficits ballooning toward $2 trillion, investors are scrutinizing whether the Treasury will adjust auction sizes or borrowing projections. Many bond dealers expect no changes to coupon note and bond issuance, given Treasury Secretary Besset’s preference for short-term T-bills, but questions are growing about how long this patient approach can last.

Thin Liquidity Magnifies the Risk.

The seasonal backdrop could amplify any reaction. With many institutional investors away and trading volumes lower during the summer, liquidity is thinning at a time when multiple catalysts are converging. This leaves markets primed for outsized moves: any surprise—from the Fed, Big Tech earnings, economic data, Treasury auctions, or tariff negotiations—could trigger volatility that sets the tone for the remainder of the summer.

↑ Back to top

↑ Back to top