Between Tailwinds and Turbulence

As of June 18, 2025

Parsing Opportunity and Risk as the Second Half Begins

As the first half of 2025 comes to a close, markets are navigating a delicate balance: momentum fueled by record equity highs and policy flexibility, countered by stubborn inflation, a steepening yield curve, and renewed fiscal and geopolitical uncertainty. The question now is not just “Where do we go from here?”—but how to chart a course between the competing forces of tailwinds and turbulence.

Below, we break down the outlook by macro backdrop and asset class:

FOMC: Still Waiting for Confidence

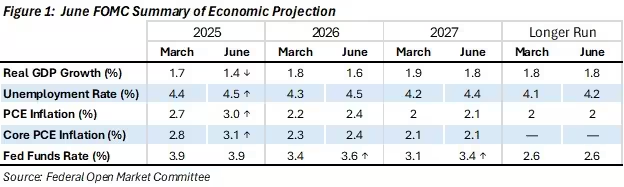

The June FOMC meeting delivered the expected policy hold, but the updated Summary of Economic Projections (Figure 1) reinforced a more cautious stance. Chair Powell emphasized that the Fed remains firmly data-dependent and is looking for “greater confidence” that inflation is on a sustained path downward before considering any rate cuts. The tone and projections pointed to a longer runway for restrictive policy, with fewer cuts anticipated over the coming years.

Key Takeaways

- GDP growth was revised lower, reflecting expectations for a modest slowdown.

- Unemployment was nudged higher, pointing to softening labor market conditions.

- Inflation projections, both headline and core, were revised higher—highlighting persistent price pressures.

- Fed Funds rate projections for 2026 and 2027 were revised up by 20–30bps, signaling a shallower cutting cycle ahead.

From Cuts to Crosswinds: July’s Fixed Income Outlook

Now that the FOMC is behind us, July’s market narrative shifts to a three-way balancing act between policy clarity, corporate earnings, economic figures and evolving global dynamics.

While geopolitical risks remain a backdrop, recent developments—such as the rare-earth trade agreement between the U.S. and China—signal a more measured tone in bilateral relations, at least for now. The July 9 tariff pause remains a key marker, but instead of renewed escalation, the focus has shifted to strategic cooperation and supply-chain alignment.

At the same time, Q2 earnings season will test equity valuations, and incoming CPI/PPI data could materially shift expectations around the timing and pace of rate cuts.

The Fed remains divided, with some officials pressing for patience while others cite softening labor demand as justification for easing sooner.

Fixed Income Implications:

- Short-end yields remain anchored by cooling inflation and labor trends, while the long end stays sensitive to macro headlines.

- Credit spreads have tightened in line with equity performance, though the strength may be tested if earnings disappoint or volatility returns.

- Global demand for U.S. short duration remains strong, driven in part by easing abroad and relative yield advantage.

- Real yields remain elevated, and quarter-end liquidity dynamics could add pressure to lower-quality segments.

In short: fixed income markets are threading the needle—between resilience and risk.

July may offer more cooperation than conflict, but with the data still in the driver’s seat, caution remains key. Investors are likely to favor liquidity, quality, and flexibility in both credit and duration positioning.

Equities: What’s Keeping the Rally Alive?

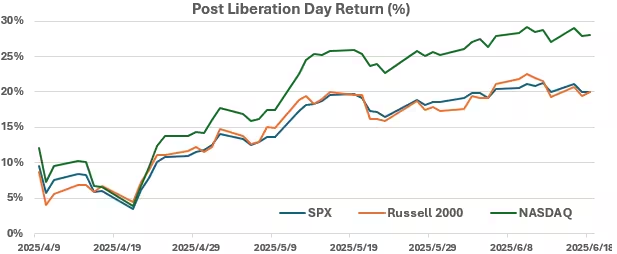

Despite mixed macro signals, the S&P 500 closed June at new all-time highs, buoyed by strength in megacap tech, industrials, and energy. Market breadth has improved but remains below prior bull cycle peaks, when nearly 85% of S&P stocks traded above their 200-day moving average—compared to about 60% today (WSJ).

Small caps, which had increasingly lagged broader equity trends earlier this year, have shown signs of catching up in Q2—outperforming large caps since Liberation Day as investor appetite broadens and capital rotates into cyclical and domestically focused sectors.

What’s driving performance?

- FOMO-driven rotation: Investors who missed the AI-led rally and “Liberation Day” bounce are shifting into more defensive or under-owned sectors. U.S. equities recorded $19.8 billion in inflows (Bank of America via Reuters).

- Earnings resilience, especially in tech and consumer services, continues to support sentiment.

- Stable rate expectations and hopes for eventual Fed cuts are helping sustain elevated equity multiples.

As we enter the second half of the year, every inflation release and labor print becomes pivotal.

A soft CPI or disappointing payrolls number could reopen the door to a September rate cut.

But any upside surprise may push the Fed’s pivot into 2026—adding more chop to already conflicted markets.

Between tailwinds and turbulence, the road ahead demands agility, discipline, and a focus on fundamentals. Risk and opportunity are moving targets—and investors who remain grounded, yet flexible, may be best equipped for the journey ahead.

↑ Back to top