From Liberation to Rotation — And a New Yield Reality

As of May 22, 2025

Since April 2nd—“Liberation Day”—markets have undergone a remarkable transition. What started as a sharp drawdown in equities and risk assets has evolved into a powerful rotation, supported by tactical policy recalibration, earnings resilience, and a now inescapable shift in the cost of capital.

A Rebound Fueled by Policy Pause and Earnings Resilience

After the initial 12% plunge in the S&P 500, investors recalibrated when the administration announced a 90-day pause on the broadest tariff measures. While China-targeted tariffs remained, the signal of strategic flexibility helped calm markets. That, paired with 75% earnings beat rate in Q1 and stabilizing EPS forecasts (~$268 for 2025 per FactSet), helped recover a significant portion of April's losses.

The S&P 500 now hovers near 6,200, well off the post-announcement low, and forward-looking indicators suggest the panic was overdone. April CPI cooled to 2.3% YoY, and the PPI decline of -0.5% MoM added fuel to the rebound.

But there’s a parallel story that’s just as important: yields have not come back down. In fact, they’re anchoring a new valuation reality.

What’s Driving Long-End Government Bond Yields? (As of May 21, 2025)

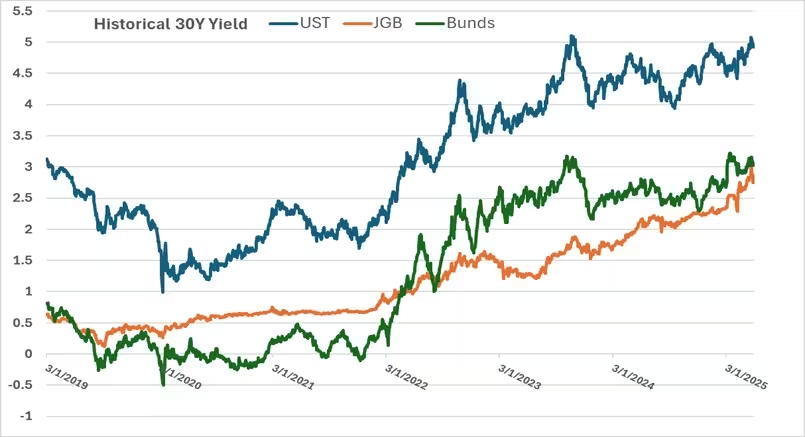

Yields on long-dated government bonds have surged not just in the United States, but across all major developed markets, reflecting a broad repricing of duration risk. Investors are navigating persistent fiscal pressures, less predictable central bank behavior, and a global rebalancing of sovereign debt supply and demand.

United States – 30Y Treasury Yield: 5.08%

- Fiscal Stress: A proposed $3.3 trillion tax-and-spending package is driving deficit projections higher.

- Moody’s Downgrade: The U.S. credit rating was cut from Aaa to Aa1. Note S&P cut back in 2011.

- Weak Auction Demand: Treasury auctions have shown poor coverage and elevated tail risk.

- Inflation Anchoring, Not Collapsing: April CPI eased, but the term premium remains elevated.

Japan – 30Y JGB Yield: 3.19% (Record high)

- Policy Normalization: The BOJ has ended yield curve control and hiked rates to 0.5%.

- Persistent Inflation: Core CPI has proven stickier than expected.

- Auction Weakness: Long-end demand is thinning as policy normalization picks up.

United Kingdom – 30Y Gilt Yield: 5.52%

- Global Rate Transmission: U.K. rates are reacting to U.S. bond market shifts.

- Debt Dynamics: Rising public borrowing needs are drawing investor scrutiny.

- BoE Ambiguity: The Bank of England is staying cautious despite inflation pressures.

Germany – 30Y Bund Yield: 3.17%

- Fiscal Expansion: Germany’s move away from strict austerity is raising long-end supply expectations.

- ECB Uncertainty: Policy normalization is progressing unevenly.

- Repricing of European Term Premium: Investors are demanding more for long-dated duration risk.

The Investment Implication: It’s Not Just a Rebound—It’s a Reset

The rise in yields across developed economies is not just noise—it’s a structural repricing of duration risk. For equity investors, this means higher discount rates and a renewed emphasis on earnings quality, balance sheet strength, and free cash flow generation. Companies that can fund growth internally, price through inflation, and operate globally are better positioned than ever.

Meanwhile, global rotation is back. With U.S. equities commanding a ~20.8x forward P/E, international markets—Japan (13.5x), Europe (14.7x), and EM (11.2x)—offer meaningful valuation cushions and differentiated macro drivers (FactSet, Bloomberg, & MSCI).

Looking Forward

Markets may have rallied off the April lows, but they are not returning to the old regime. Tariff uncertainty remains, fiscal risk is rising, and central banks have stepped back from their role as reliable volatility dampeners.

In that world, staying invested isn’t about chasing beta—it’s about tilting toward resilience, regional balance, and real earnings power.

What’s coming up?

- Big Beautiful Bill: How much deficit will B Cube add to the future deficits?

- 06/02/2025: Institute for Supply Management (ISM)

- 06/06/2025: Non-farm payroll & Unemployment Rate